Lowering your repayments is a key priority. The repayments are based on a number of factors including your credit rating, the age of the business, your business economics, your asset base, the amount you borrow, the term, fees, and interest rates. We work with lenders who offer the most competitive rates across all these elements.

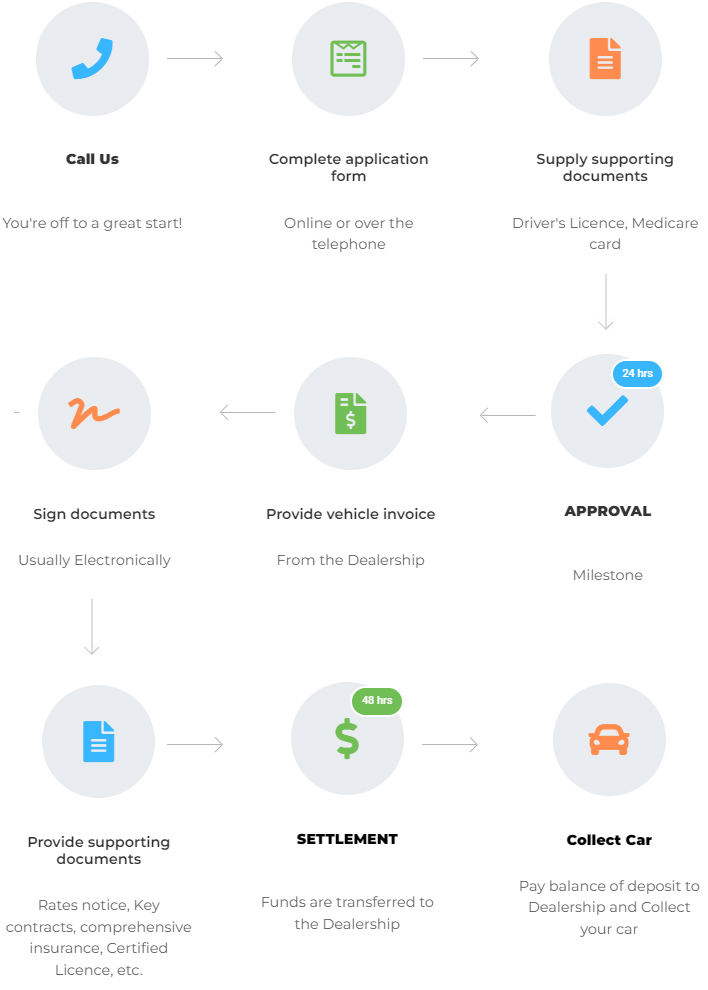

It is not uncommon to have applications approved and settled within a day. Normally, approval can be gained in 24 hours, and settlement within 48 hours.

Businesses that have been operating for less than 2 years can have difficulty getting finance particularly from the banks and large lenders. We specialise in finance for new businesses - min. 3 months operations - and have a Success rate of 94%.

We are a small, professional team leveraging 30 years of experience to find you the right finance, and complete the process as efficiently as possible. We are approachable yet direct and prefer clarity and action over salesmanship.

We believe the greatest benefits are achieved from better relationships with fewer lenders. Some providers believe a large panel of lenders is best but our experience shows better results for clients are achieved through deeper partnerships with 10-15 lenders.

Low-doc loans are our forte - 100% of the applications we process are Low-doc loans. It is worth noting that Low-doc loans require a lower number of supporting documents, and that they are NOT No-doc loans (no such thing).

You're off to a great start!

Online or over the telephone

Driver's Licence, Medicare card

Milestone

Funds are transferred to the Dealership

Rates notice, Key contracts, comprehensive insurance, Certified Licence, etc.

Usually Electronically

From the Dealership

Pay balance of deposit to Dealership and Collect your car